LendeXe Whitepaper

Version 1.0.2 | Oct 2023

Introduction

In the pulsating landscape of digital finance, we face a paradox – on the one hand, blockchains offer immense opportunities, on the other hand, liquidity remains trapped in their respective silos. This fragmentation of liquidity makes it difficult for users to experience the full range of DeFi innovations. Here, LendeXe enters the scene, a protocol dedicated to bridging these liquidity silos to enable a seamless, safe, and profitable DeFi experience. Through the integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), LendeXe aims to usher in an era of secure and flowing liquidity. Our vision is to create an ecosystem where the safety of assets and the protocol is ensured, while users can safely utilize the benefits of the DeFi landscape. With LendeXe, a journey begins into a future where the financial boundaries between different blockchains blur, and a seamless, user-centered DeFi experience is enabled, with LendeXe acting as a robust infrastructure for lending, allowing everyone to move safely in the DeFi world while simultaneously preserving the interests and liquidity integrity of the involved blockchains.

At the heart of the LendeXe platform is the XSD-Equilibrator Hub, an expression of our vision to create a world where liquidity can flow freely, regardless of the boundaries of individual blockchains. The Equilibrator Hub aims to become a central hub for stablecoins, providing users protection and promoting development towards the FX market. Additionally, assets within the hub are used for yield farming to support and incentivize the COLLABORATIVE Liquidation Hub, creating an additional level of security and reward for users.

Another milestone of our platform is the newly developed Liquidation Hub, enabling cross-chain liquidation. This collective hub is designed to secure every upcoming liquidation with the provided liquidity, making LendeXe a robust partner in turbulent market times.

Our unique tokenomic design is aimed at minting XSD tokens through fee collection and providing them as Undercollateralized LendeXe Loan. In this innovative lending model, users can provide 100% of the collateral and receive a loan of up to 150%, financed by the protocol itself. This model is a direct result of our DAO structure, where no fees flow to third parties, but instead are fed back into the ecosystem to promote further growth and user engagement.

With a User-Loyalty-Program that encourages community engagement, and the unlimited scalability enabled by the XSD-Equilibrator Hub, LendeXe positions itself at the forefront of the movement to overcome liquidity fragmentation. We aspire to a future where the DeFi world is no longer separated by silos, but by a network of connected liquidity pools enabling a seamless, safe, and user-driven experience.

LendeXe is not only an answer to the current stagnation in the DeFi sector but also a preparation for the upcoming fusion of crypto-based and traditional financial systems. With our robust, scalable, and interoperable platform, we set the stage for seamless integration and cooperation between these hitherto separated financial worlds, as the traditional financial landscape continues to move towards DeFi.

The XSD Stablecoin

XSD is a fully on-chain decentralized Collateralized Debt Position (CDP) system, hard-pegged to the US Dollar, mintable by depositing Tether (USDT), USD Coin (USDC) or MakerDAO (DAI) via the XSD Equilibrator Hub. Depending on market forces, XSD can be over-collateralized by 100 to 233% through a basket of tokens.

Store of Value

XSD, backed by three assets and hard-pegged to the US Dollar, serves as a store of value, preventing depreciation over time. If one of the stablecoin collaterals declines, the XSD Equilibrator Hub’s automated swap mechanism, designed for XSD Collateral, replaces the fallen one with others. There are no technical limitations on the number of stablecoins; post XSD launch, more stablecoins will be added to the basket to cater to every user.

User Protection

Powered by smart contracts, user protection when minting XSD is transparent and safeguarded by the automated management and oversight mechanism of the XSD Equilibrator Hub, ensuring optimal stablecoin asset allocation through carefully devised strategies.

Stability mechanism

Using XSD Equilibrator Hub, everyone can mint/burn XSD by supplying/withdrawing USDT, USDC or DAI. The XSD Equilibrator Hub always considers the face value of XSD (1 XSD = 1 USD). To push the stability, 60% of LendeXe Reserve Factor will be swapped with 50% USDT, 30% USDC and 20% DAI to be poured directly into XSD Equilibrator Hub.

To use the XSD Equilibrator Hub, users pay a

0.1% minting fee when XSD=>$1 and a

0.1 to 5.0% minting fee when $0.998<XSD<$1, and a

0.1% burning fee when XSD<=$1.002 and a

0.1 to 5.0% burning fee when $1.002<XSD<$1.050.

If XSD<$0.998, minting stops and if XSD>$1.050 burning stops. These fees will be used to buyback and burn LEXE.

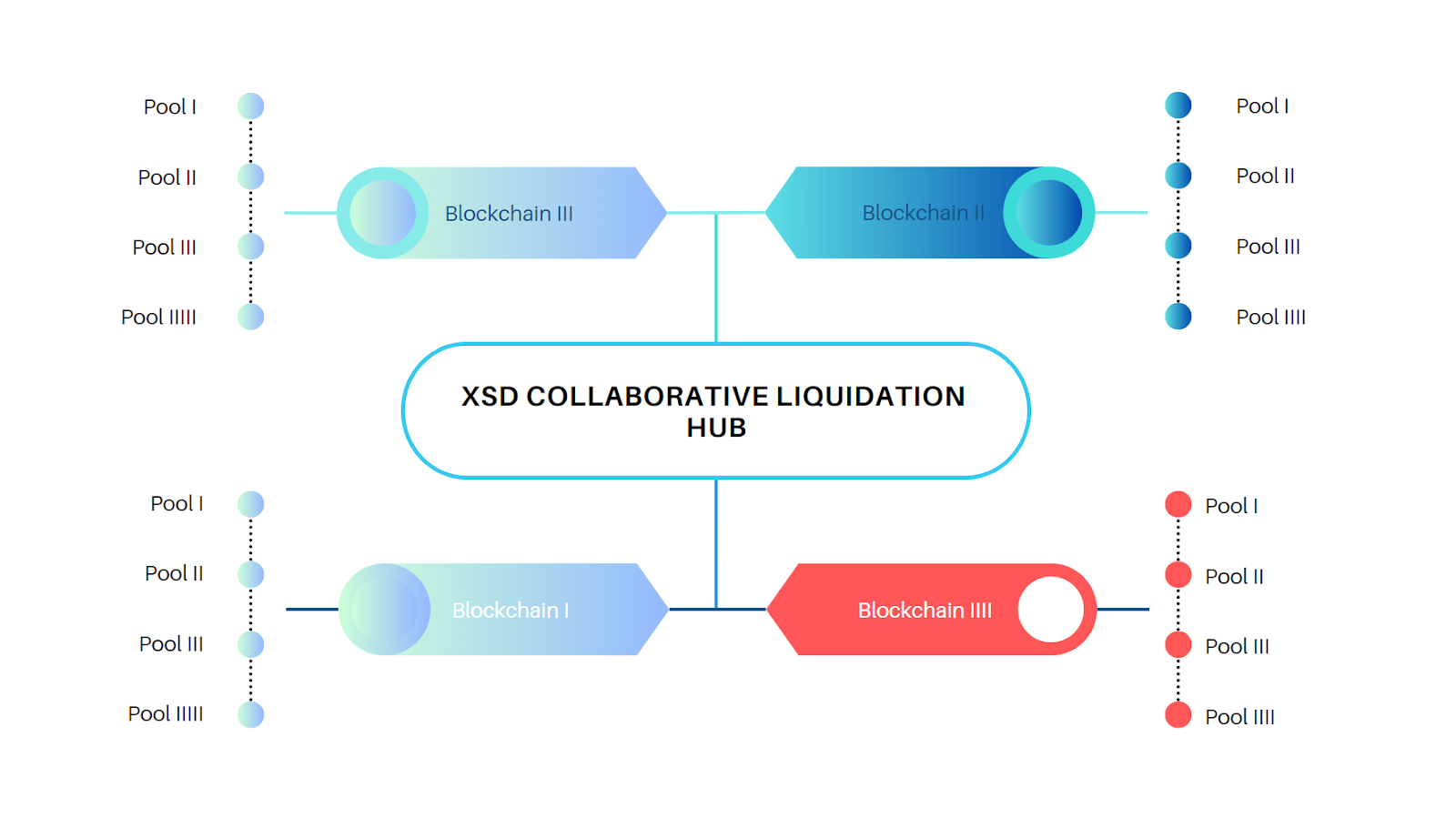

Collaborative XSD Liquidation Hub

The XSD Collaborative Liquidation Hub is the long time needed standard designed as collective liquidation hub, and the old liquidation risks are no longer the problem of the protocol and community.

Benefits:

a. Shared Participation Incentives: Encouraging collective efforts to ensure asset liquidation is handled efficiently and fairly across the network.

b. Enhanced Automation & Interoperability: Seamlessly connect and interact with different blockchain protocols, automating processes and enhancing cross-chain functionalities.

c. Robust Liquidation Mechanism: A strong framework ensuring timely and fair asset liquidation, minimizing risks and ensuring market stability.

d. Simplified User Experience: User-friendly interface and processes, making participation in liquidation processes straightforward.

e. Scalable Cross-Chain Security: Expanding security measures across multiple chains, ensuring a safe and stable operational environment while boosting DeFi adoption.

Incentivized with Liquidation Fees, Liquidity Mining and boosted rewards.

Lending and Borrowing

General

LendeXe is a liquidity ecosystem and so far three different types of liquidity streams have been designed for its users. These three types are Dynamic Supplying/Borrowing (Lending) in form of preferred collateral and loan, Undercollateralized LendeXe Loan (ULL) in form of LEXE as collateral and XSD as debt and Interest-Free Loan (IFL) in form of BTC, ETH and WETH as collateral and LXD as debt.

Dynamic Supplying/Borrowing (Lending) Supplying cryptocurrencies in Lending

This service of LendeXe contains several pools for different cryptocurrencies. Users can deposit their preferred assets into these pools to have access to continuous passive supplying interest, which is dynamic and based on a pre-designed interest rate algorithm that functions correspondingly to the market conditions. There is no time limit and suppliers can always demand withdrawal. Supplied balances are represented by synthetic balance-tokens called xToken in suppliers wallets. As time goes on and users xTokens accrue interest, their balance will remain constant but their exchange rate increases. When a user wants to redeem their xToken and withdraw their initial supplied token, they would withdraw an increased amount which has their initial tokens and accrued interest together.

Example. A user opens a position with a $10k BTC deposit and receives 10k xBTC instead. After a year, BTC has faced a 10% average supply interest rate but the user still has the initial 10k xBTC. As xBTC accrued interest over the year, the exchange rate between BTC and xBTC has changed and if the user decides to withdraw their BTC by redeeming 10k xBTC, they will receive $11k BTC.

Borrowing cryptocurrencies via Lending

After supplying, users can use their xTokens as collateral to borrow assets from the pools Each asset has its own liquidation threshold which determines its maximum borrowing power.

Borrowing_Power = Collateral_Value x Collateral_Liquidation_Threshold

Loans have no maturity date, no monthly payment obligation, and their interest rates are calculated algorithmically using market forces.

Example. A user opens a position with a $10k BTC deposit and receives 10k xBTC instead. To use BTC as collateral to borrow ETH, they simply lock their 10k xBTC and withdraw up to $7k ETH (BTC borrowing power is 70%). After a year, BTC has faced a 10% average supply interest rate and ETH has faced a 12% average borrowing interest rate. If the user decides to withdraw their BTC, they should repay $7.84k ETH (= $7k ETH + 12% interest) to free their 10k xBTC and then redeem their 10k xBTC to withdraw $11k BTC. These numbers are apart from LEXE reward for borrowers.

Interest Rates

LendeXe protocol’s interest rate model makes sure that each market is functioning in an equilibrium between lenders and borrowers. The rates will be calculated algorithmically based on each pool’s Utilization Rate and the slopes are different for different markets.

Utilization_Rate = Total_Borrowed / (Total_Supplied + Total_Borrowed)

The higher the Utilization Rate, the higher the rates for lenders and borrowers. Using a jump-rate model, the slopes of the interest rates increase dramatically above the optimum utilization point, which prevents facing lack of liquidity in the pools. Interests are in the same tokens that users are supplying or borrowing.

Reserve Factor

80% of the borrowers repaid interest will go to suppliers as their passive reward of supplying, the rest will go to an address called Reserve Factor as the protocol’s revenue.

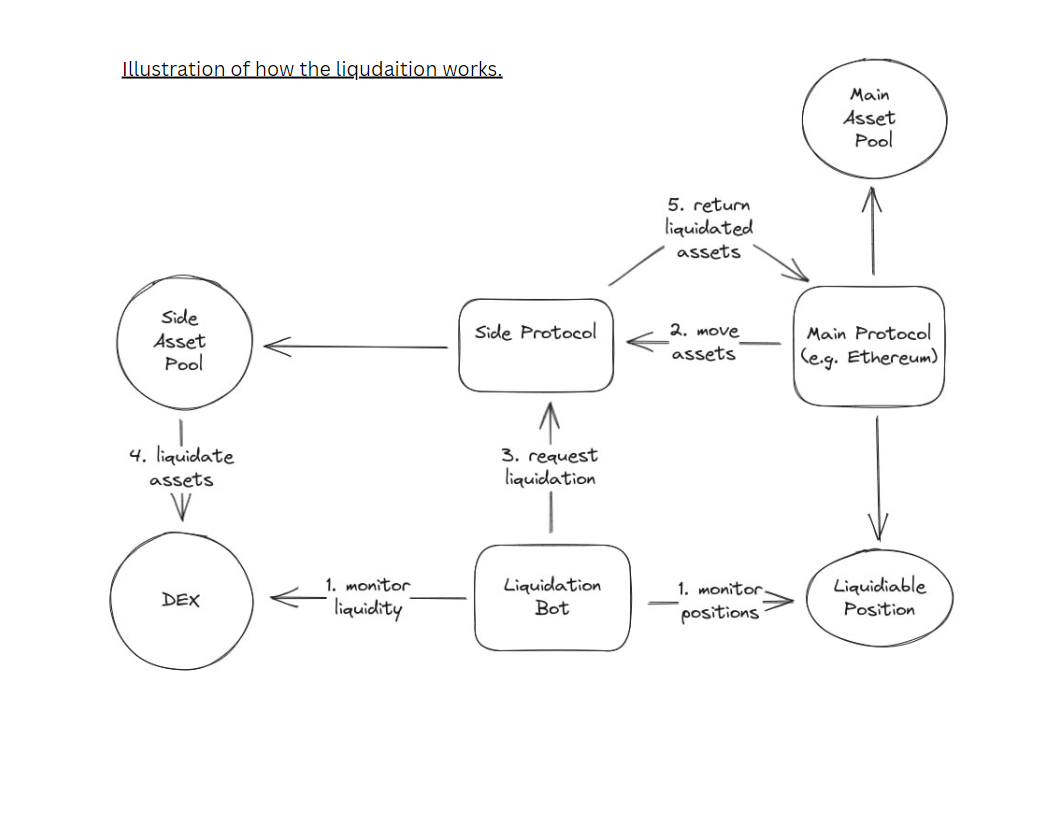

Liquidation

The LendeXe XSD Collaborative Liquidation Pool – Empowering Community Participation

One of the standout features within the LendeXe DeFi Lending ecosystem is the innovative LendeXe XSD Collective Liquidation Pool. This pool offers users the opportunity to actively participate in the liquidation process, contributing to the stability and security of the platform.

Traditional liquidation models, like the auction-based approach used by Compound Finance, have limitations and may not fully engage the community. In contrast, LendeXe adopts a more community-centric approach with its XSD Pool, where users can supply their XSD Stablecoin to support the liquidation process and at the samevincrease the security of the infrastructure.

How it works:

- User Contribution: Users have the option to supply their XSD Stablecoin to the XSD Pool specifically designed for liquidations. By contributing to the pool, users actively participate in the liquidation mechanism and play a crucial role in maintaining the integrity of the LendeXe Finance ecosystem.

- Liquidation Process: When a borrower’s position becomes undercollateralized and triggers a liquidation event, the XSD Pool comes into action. The XSD Stablecoin supplied by the community acts as a safeguard, ensuring that the liquidation process is swift and effective.

- Community Incentives: As a reward for their active participation, community members who contribute to the XSD Pool receive multiple benefits:

-

LEXE Liquidity Mining: Participants in the XSD Pool also become eligible for LEXE liquidity mining rewards, further incentivizing their involvement in securing the ecosystem.

-

Liquidation Incentive: Users receive a 8% liquidation incentive at the end of the liquidation process as a reward for their contribution. In total, the Liquidation Penalty is 10% of the liquidated collateral, from which 8% will go to Collaborative Liquidation Hub and 2% to Reserve Factor.

-

APY Distribution: Additionally, users in the XSD Pool receive a share of the generated Annual Percentage Yield (APY) from the yield-boost algorithm of XSD Stablecoin. This distribution ensures that participants are actively rewarded for their ongoing commitment to the platform by getting protocol driven rewards. Pool as Liquidation Incentive for the participants and 2% goes to LendeXe Reserve Factor to fuel the Ultimate Loan.

Numerical Example:

- Consider an example to better understand the potential benefits of the LendeXe Liquidation Pool:

-

User A supplies 500 XSD Stablecoins to the XSD Pool for liquidations.

-

During a liquidation event of a BTC position, the XSD Pool contributes to the process, aiding in the timely and efficient liquidation of the undercollateralized position.

-

As a result of the successful liquidation, User A, who contributed 500 XSD Stablecoins, receives $540 XSD ($500 XSD equal to the initial supply plus $40 XSD as the 8% liquidation incentive).

-

User A is also eligible for LEXE liquidity mining rewards and receives a share of the generated APY from the yield-boost algorithm of XSD Stablecoin.

- In this scenario, User A not only played an active role in maintaining the stability of the LendeXe DeFi Lending ecosystem but also earned rewards for their contribution and ongoing participation.

By incorporating the LendeXe Liquidation Pool, the platform fosters community engagement, promotes a more decentralized and secure lending environment, and provides users with multiple incentives to actively participate in securing the ecosystem. Through this community-driven approach, LendeXe Finance takes a significant step towards building a robust and sustainable DeFi lending platform with interoperability liquidation mechanism.

Lending Liquidation

To ensure having enough collateral to cover the value of all outstanding loans, risky positions will face collateral liquidation. Each collateral type asset has its own liquidation threshold, which will be used to calculate the Health Factor of its positions.

Health_Factor = (Collateral_Value x Collateral_Liquidation_Threshold) / Loan_Value

If the Health Factor of a position drops under 1.0, half the position’s collateral will get liquidated to repay a proportion of its debt. If the Health Factor raises above 1 after the liquidation, the process stops. If not, the process repeats.

The liquidation takes place in an instant action by LendeXe XSD Liquidation Hub in which 10% of the liquidated collateral will be charged as Liquidation Penalty.

Example. A position with $10k BTC collateral and $7k ETH debt faces liquidation. As BTC Liquidation Threshold is 70%, this position’s Health Factor is =<1.0 (= ($10k x 70%) / $7k) which triggers the liquidation. 50% of the collateral will get liquidated with 10% penalty, this means $5k BTC will get liquidated with $0.5k penalty to eliminate $4.5k of the debt. Now the position has $5k BTC collateral and $2.5k ETH debt. The current health factor is 1.4>1.0 (= ($5k x 70%) / $2.5k) which stops the liquidation.

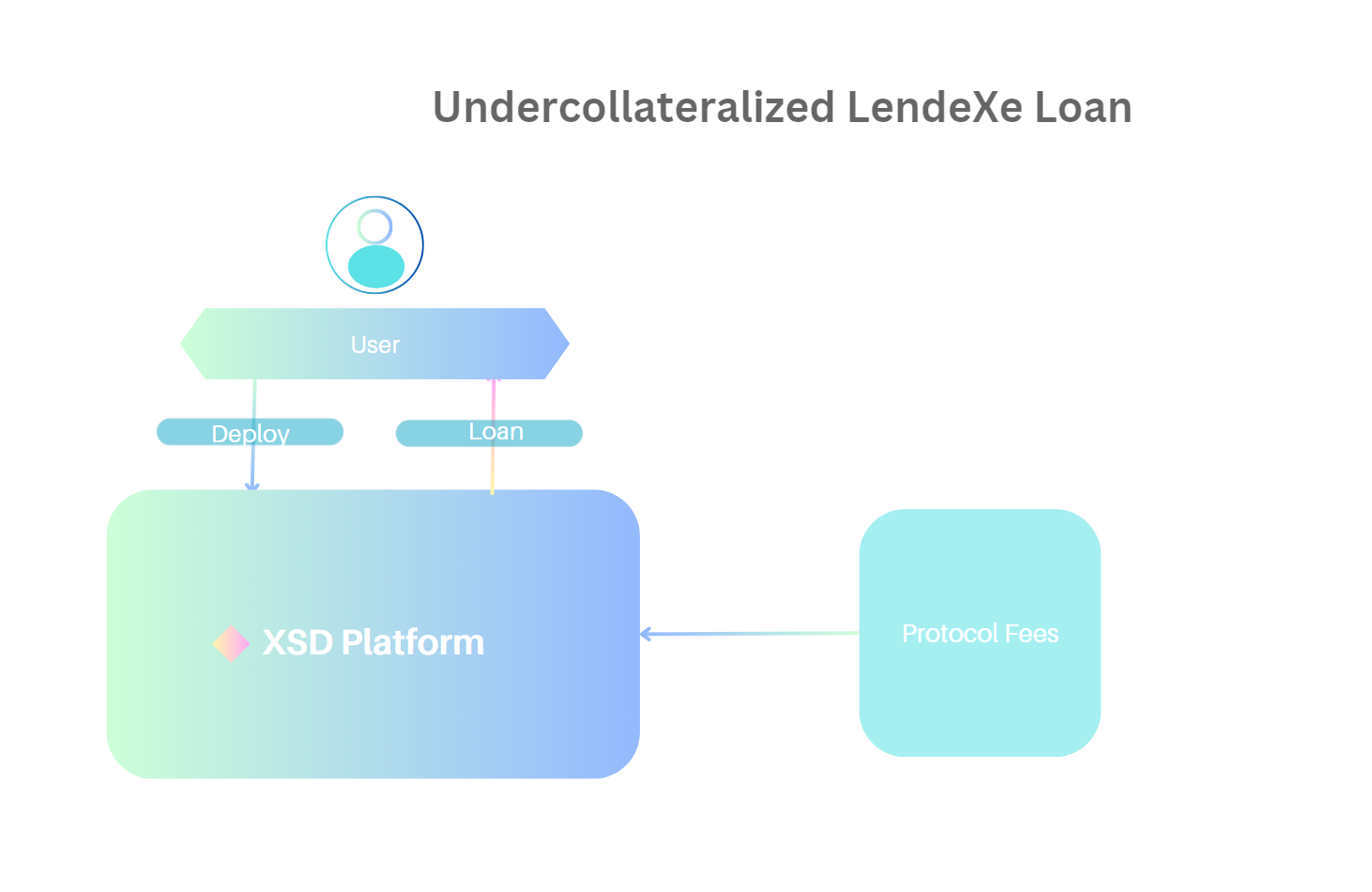

Undercollateralized LendeXe Loan (ULL)

Unveiling a new standard for lending, the LendeXeDAO ecosystem introduces the Undercollateralized LendeXe Loan (ULL), a groundbreaking feature that reimagines the lending landscape. By permitting users to borrow up to 1.5 times their collateral’s value, ULL challenges the conventional lending paradigm. This is made possible as LEXE token holders are benefiting from incentivization of the protocol, as LendeXe protocol collateralizes the loans with the protocol income/fees. Upon locking their LEXE tokens for 3, 6, or 12 months, users unlock a 1.5x loan in XSD, repayable within 15, 30, or 60 days, heralding a new wave of financial empowerment and innovation within the decentralized finance space. The ULL ensures a sustainable mining performance of XSD.

Undercollateralized LendeXe Loan Liquidation

Undercollateralized LendeXe Loan borrowers have a 15, 30, or 60 day window to repay their debt. If the repayment window passes or their collateral’s value drops by 20%, their collateral will get liquidated on the spot.

Example 1. A position with $10k LEXE, $5k xUSDT, $3k xUSDC and $2k xDAI collateral and 15k XSD debt passes its repayment window. The protocol burns $2k LEXE on spot and transfers $8k LEXE to a vault called LEXE/XSD Stability Pool. Then it transfers $5k xUSDT, $3k xUSDC and $3k xDAI to XSD Equilibrator Hub.

Example 2. A position has been opened with $10k LEXE, $5k xUSDT, $3k xUSDC and $2k xDAI collateral and 15k XSD debt but it faces a 20% drop in LEXE value, so the current situation is $8k LEXE, $5k xUSDT, $3k xUSDC and $2k xDAI collateral and 15k XSD debt. The protocol burns $1.6k LEXE on spot and transfers $6.4k LEXE to a vault called LEXE/XSD Stability Pool. Then it transfers $5k xUSDT, $3k xUSDC and $2k xDAI to XSD Equilibrator Hub.

Mechanism

40% of the Reserve Factor’s funds will be swapped with 50% USDT, 30% USDC and 20% DAI to be stored in the Undercollateralized LendeXe Loan Pool of Funds. Whenever a user locks an amount of LEXE for a chosen time period, the protocol locks an amount of stablecoins equal to the share of the locked Lexe to the total supply of LEXE multipled by LendeXe Loan Pool of Funds content. It then mints an equal amount of XSD. The loan has 0% APY (Annual Percentage Yield) but users have to pay a 1% minting fee.

Example. A user opens a position by locking 10M LEXE for 3 months. The Lendexe Loan Pool of Funds contains $1M. At the end, the protocol will lock $5k xUSDT, $3k xUSDC and $2k xDAI on behalf of the user as well as $10k LEXE from the user to have $20k collateral in total and mints 15k XSD to provide liquidity for the user. ULL fees will be collected automatically in the LEXE pool and managed by LendeXeDAO

Interest-Free Loan (IFL)

This feature brings utility for BTC, ETH and WETH tokens on IOTA and Ethereum Networks.

Users can lock their BTC, ETH or WETH in separate repositories and use them as collateral to borrow 110% collateralized loans in the form of LXD stablecoin. The loan has 0% APY and no maturity date but users have to have a minimum debt of 2,000 LXD from which a 200 LXD plus 0.5 to 5.0% will be held inside the repository as liquidation reserve and minting fee (upon liquidity amount). The fee rises linearly from 0.5% to 5.0% as LXD redemption frequency increases. If the repository faces no liquidation, the liquidation reserve will be given back to the user.

Example. A person opens a position with $10k BTC collateral and demands 9k LXD liquidity. The protocol holds 200 LXD as liquidation reserve plus a 45 LXD minting fee (= 0.5% x $9k) inside the repository and charges the person’s wallet with 8,755 LXD.

LXD

LXD keeps its peg using three different mechanisms called hard-peg, redemption and dynamic fees. The hard-peg means the protocol always considers the face value of LXD (1 LXD = 1 USD), so borrowers will be encouraged to mint more whenever LXD>$1 and to repay their debt whenever LXD<$1. The redemption is a process in which an LXD holder can bring it to the protocol to swap it with BTC, ETH or WETH, no matter if they have an active position or not. The dynamic fee increases LXD minting fee whenever the redemption frequency increases, as it can be a sign of price decrease.

Price Stability Mechanisms

The LXD Stablecoin

LXD is a fully on-chain decentralized CDP hard-pegged to the US Dollar.

Users mint LXD by locking Bitcoin (BTC), Ether (ETH) or WETH coins into Interest-Free Loan (IFL). They can also buy it from brokers or exchanges, or simply receive it as a means of payment.

- Store of value

-

LXD is backed by a mechanism which holds its peg to the US Dollar. This makes it a store of value as it won’t show depreciation over time. Everyone who has LXD can bring it to the protocol and redeem it against BTC, ETH and WETH. This action can be done even by people who have not borrowed it from LendeXe.

- Medium of Exchange

-

LXD is hard-pegged to US Dollar, which means it can easily be used for all kinds of transactions with no limit.

- Debt Payments

-

Using LXD, users can repay their Interest-Free Loan debt.

- Passive Income

-

Depositing LXD in IFL Liquidation Pool, everyone can gain liquidation income and LEXE reward.

Repayment

As IFL positions have no maturity date, users can repay their debts whenever they want.

Example. A person has opened a position with $10k BTC as collateral and demanded 9k LXD liquidity. The protocol has given them 8,755 LXD liquidity and holds 200 LXD as liquidation reserve and 45 LXD minting fee. To repay the debt and withdraw $10k BTC, the user just needs to repay 8,800 LXD as the 200 LXD liquidation reserve has not been used.

Redemption

Using this feature, everyone can redeem their LXD at face value to gain BTC, ETH or WETH after paying a 0.5- to 5.0% redemption fee (upon BTC, ETH or WETH amount) plus gas compensation. The protocol uses the redeemers LXD to repay the debt of the riskiest repositories on behalf of their owners. The maximum collateral loss of the repositories during a redemption is equal to their repaid debt (as collateral and debt reduction are the same, the total loss is equal to 0) and the redeemer will gain no excess value unless LXD<$1.

Example. Person A has a repository with $10k BTC as collateral and 9k LXD as debt (111% collateralized), which is the riskiest repository of IFL at the moment. Person B buys 5k LXD from the market and brings them to IFL to redeem and withdraw $5k BTC. Person B pays 5k LXD, and the protocol uses the mentioned 5k LXD to repay 5k LXD debt of person A. In exchange, the protocol withdraws $5k BTC from Person A’s repository to repay person B. After subtracting $25 BTC (= $5k x 0.5%), person B receives $4,975 BTC (apart from gas compensation). Now person A has a repository with $5k BTC collateral and 4k LXD debt (125% collateralized).

Liquidation

Interest-Free Loan Liquidation

IFL liquidation falls under 2 categories named Normal Mode and Recovery Mode.

In Normal Mode, any position which faces a collateral factor lower than 110% will face liquidation. The Recovery Mode is for when the total collateral ratio of IFL falls below 150%.

In both categories, IFL uses a 2 layer defense system starting with IFL Liquidation Pool.

Liquidation via IFL Liquidation Pool

IFL has a feature called Liquidation Pool. Everyone can deposit their LXD into IFL Liquidation Pool. In case of any repository’s liquidation, its collateral will be distributed among liquidation pool depositors in exchange for their LXD. Since the liquidation starts at 110% collateral ratio, liquidation pool depositors gain a 10% reward. The distribution is based on each user’s deposit’s weight inside the pool. This is apart from pool’s participants LEXE reward.

Example. A repository with $11k BTC collateral and 10k LXD debt faces liquidation. The protocol gathers 10k LXD from its liquidation pool to repay the repository’s debt and distributes the $11k BTC collateral of the repository among liquidation pool participants. At the end, liquidation pool depositors have lost 10k LXD but gained $11k BTC.

In case there are not enough funds inside the liquidation pool to liquidate the collateral, the protocol distributes both remaining collateral and debt of the liquidated repository among other repositories, starting from the safest ones. As collateral is 110% of the debt, this does not trigger liquidation for others.

Recovery Mode

- If the total collateral ratio of the IFL falls below 150%, the protocol enters recovery mode and will stop accepting any under 150% collateral ratio repository. The protocol runs the following action until its collateral ratio goes above 150% again.

- If a repository’s collateral ratio is <100%, 100% of its collateral and debts will be redistributed among other active repositories, starting from the safest ones.

- If a repository’s collateral ratio is between 100% and 110%, 100% of its collateral will get liquidated and its debt will be tackled by the liquidation pool. If there is not enough LXD in the liquidation pool, any remaining collateral and debt will be redistributed among other repositories, starting from the safest ones.

- If a repository’s collateral ratio is between 110% and 150%, 100% of the repository’s debt will be repaid by the liquidation pool in exchange for 110% of the debt’s value, subtracting from its collateral. The surplus collateral will remain in the repository. This action can’t be done if there is no LXD inside the liquidation pool.

- If the total collateral ratio of the IFL falls below 110%, the protocol stops accepting new positions and swaps all collaterals with 50% USDT, 30% USDC and 20% DAI starting from the riskiest one. It continues until when the ratio goes above 110% again.

Example. The total collateral ratio of the IFL drops below 150% and the protocol starts liquidation of <150% collateral ratio repositories, starting from the riskiest ones. A repository is 120% collateralized with $12k BTC collateral and 10k LXD debt. The protocol liquidates $6k BTC of the collateral to repay 6k LXD debt. Now the repository is with $6k BTC collateral and 4k LXD debt which means 150% collateral ratio and this repository’s liquidation stops.

Interest-Free Loan issuing and redemption fees go to LendeXe Reserve Factor.

Tokenomic

What is $LEXE

LEXE is the native token of LendeXe and the heart of its infrastructure. All products and features of LendeXe are linked to LEXE. The token gives you the right to make decisions that lead the protocol to next milestones via its governance. LEXE also provides unique utilities for the community to use some features of the protocol – for example the Undercollateralized LendeXe Loan.

LEXE Burning Mechanism

LendeXe does not charge any fee for normal Supplying/Borrowing, so the main use case of the protocol is feeless. Fees are for further features of the protocol. The collected fee is to buy-back and burn LEXE or to be poured into the Reserve Factor.

Tokenomic

- Liquidity Mining 30%

-

10% Lending (borrowers only) in 48 months

-

7% Interest free loan (liquidation pool) in 48 months

-

7% XSD-Liqudation-Pool in 48 months

-

3% Lending lock-drop in 12 months

-

1% LendeXe Governance in 48 months

-

2% DEX Liquidity Providers

- Partnerships and Advisors 23%

-

17 % Partnerships

-

6% Advisors

- Supporters & Friends 7.38%

-

0.28% TGE

-

0.37% in 12 monthly distribution

-

0.47% in 12 monthly distribution after 12 months cliff

-

2.76% in 24 monthly distribution

-

3.5% in 24 monthly distribution after 24 months cliff

- Pre-Seed 6%

-

1% TGE

-

5% in 24 monthly distribution after 12 month cliff

- 15% Team and further Members (12 months cliff + 36 monthly distributions)

- 10% Treasury

- 8.62%

-

3.6% Exchange Listings & Market Making

-

5.02% Marketing

Networks

LendeXe has been developed in Solidity to work with any Ethereum Virtual Machine (EVM).

Current available Networks:

Apart from Ethereum Network, LendeXe is capable of bringing the benefits of decentralized lending via Chainlinks innovative CCIP solution to more networks.

Disclaimer

The ownership of LEXE tokens does not represent any participation in LendeXe Protocol nor any rights of payment, remuneration, profit distribution or money reward of any kind. This document has been prepared in good faith to provide a comprehensive overview of the LendeXe dApp – which includes everything related to the dApp and User Interface and Back-end and Smart Contracts and is for information purposes only.

With the development of the LendeXe platform, protocol and/or any mobile applications may be amended in the following. Please also note that LendeXe project and/or protocol itself may be redesigned or otherwise revised in future, if that would be required for any material reasons (including, but not limited to: commercial considerations, technical possibilities, or the need to ensure compliance with any (existing or future) applicable laws and regulations, or any other material reasons). LEXE tokens are not intended to constitute securities in any jurisdiction.

This document does not constitute a prospectus or offer document of any sort and is not intended to constitute an offer of securities or a solicitation for investments in securities in any jurisdiction. The contents of this document are not a financial promotion. Therefore, none of the contents of this document serves as an invitation or inducement to engage in any sort of investment activity.

U.S. Persons, as defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), are prohibited from accessing this document and the LendeXe website. Nothing in this document or LendeXe website shall be deemed to constitute an offer, offer to sell, or the solicitation of an offer to buy, any securities in any U.S. jurisdiction. Each person accessing this document or LendeXe website will be deemed to have understood and agreed that: (1) he is not a U.S. citizen and he is located outside of the U.S.; (2) any securities described herein have not been and will not be registered under the U.S. Securities Act or with any securities regulatory authority of any state or other jurisdiction of the United States, and may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable state securities laws.

Do not contribute any money that you can’t afford to lose in the LendeXe PROTOCOL. Make sure you read and understand this document and any TERMS AND CONDITIONS FOR PARTICIPATING IN THE LendeXe PROTOCOL (including all warnings regarding possible token value, technical, regulatory and any other risks; as well as all disclaimers contained therein), as will be published on our website www.lendexe.fi (as they may be amended from time to time).

Should you have any questions regarding the LendeXe Project, LEXE token, the contents of this document, please, do not hesitate to contact us via info@lendexe.fi or in our Discord.